|

|

|

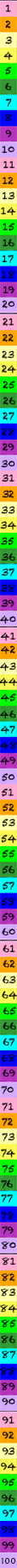

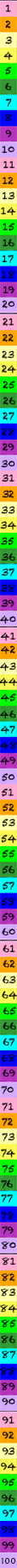

| Pages 3/2,436.9 Time 33:50:45 |

| Chapters 2/17/35 |

|

1 Capitalist Production. 4 451 6:16.

|

1 - 1 Commodoties & Money 3 152.4 2:05:50.

1 - 1 - 1 Commodoties 3 9 7:30.

1 - 1 - 1 - 1 2 Factors of a Commodity: Use-Value & Value (Substance of Value & Magnitude of Value) 9 7:30.

The wealth of those societies in which the capitalist mode of production prevails, presents itself as "an immense accumulation of commodities," 1 its unit being a single commodity. Our investigation must therefore begin with the analysis of a commodity.

A commodity is, in the first place, an object outside us, a thing that by its properties satisfies human wants of some sort or another. The nature of such wants, whether, for instance, they spring from the stomach or from fancy, makes no difference. 2 Neither are we here concerned to know how the object satisfies these wants, whether directly as means of subsistence, or indirectly as means of production.

Every useful thing, as iron, paper, &c., may be looked at from the two points of view of quality and quantity. It is an assemblage of many properties, and may therefore be of use in various ways. To discover the various uses of things is the work of history. 3 So also is the establishment of socially-recognized standards of measure for the quantities of these useful objects. The diversity of these measures has its origin partly in the diverse nature of the objects to be measured, partly in convention.

The utility of a thing makes it a use-value. 4 But this utility is not a thing of air. Being limited by the physical properties of the commodity, it has no existence apart from that commodity. A commodity, such as iron, corn, or a diamond, is therefore, so far as it is a material thing, a use-value, something useful. This property of a commodity is independent of the amount of labour required to appropriate its useful qualities. When treating of use-value, we always assume to be dealing with definite quantities, such as dozens of watches, yards of linen, or tons of iron. The use-values of commodities furnish the material for a special study, that of the commercial knowledge of commodities.5 Use-values become a reality only by use or consumption: they also constitute the substance of all wealth, whatever may be the social form of that wealth. In the form of society we are about to consider, they are, in addition, the material depositories of exchange-value.

Exchange-value, at first sight, presents itself as a quantitative relation, as the proportion in which values in use of one sort are exchanged for those of another sort,6 a relation constantly changing with time and place. Hence exchange-value appears to be something accidental and purely relative, and consequently an intrinsic value, i.e., an exchange-value that is inseparably connected with, inherent in commodities, seems a contradiction in terms.7 Let us consider the matter a little more closely.

A given commodity, e.g., a quarter of wheat is exchanged for x blacking, y silk, or z gold, &c. — in short, for other commodities in the most different proportions. Instead of one exchange-value, the wheat has, therefore, a great many. But since x blacking, y silk, or z gold &c., each represents the exchange-value of one quarter of wheat, x blacking, y silk, z gold, &c., must, as exchange-values, be replaceable by each other, or equal to each other. Therefore, first: the valid exchange-values of a given commodity express something equal; secondly, exchange-value, generally, is only the mode of expression, the phenomenal form, of something contained in it, yet distinguishable from it.

Let us take two commodities, e.g., corn and iron. The proportions in which they are exchangeable, whatever those proportions may be, can always be represented by an equation in which a given quantity of corn is equated to some quantity of iron: e.g., 1 quarter corn = x cwt. iron. What does this equation tell us? It tells us that in two different things — in 1 quarter of corn and x cwt. of iron, there exists in equal quantities something common to both. The two things must therefore be equal to a third, which in itself is neither the one nor the other. Each of them, so far as it is exchange-value, must therefore be reducible to this third.

A simple geometrical illustration will make this clear. In order to calculate and compare the areas of rectilinear figures, we decompose them into triangles. But the area of the triangle itself is expressed by something totally different from its visible figure, namely, by half the product of the base multiplied by the altitude. In the same way the exchange-values of commodities must be capable of being expressed in terms of something common to them all, of which thing they represent a greater or less quantity.

This common "something" cannot be either a geometrical, a chemical, or any other natural property of commodities. Such properties claim our attention only in so far as they affect the utility of those commodities, make them use-values. But the exchange of commodities is evidently an act characterised by a total abstraction from use-value. Then one use-value is just as good as another, provided only it be present in sufficient quantity. Or, as old Barbon says, "one sort of wares are as good as another, if the values be equal. There is no difference or distinction in things of equal value.... An hundred pounds' worth of lead or iron, is of as great value as one hundred pounds' worth of silver or gold."8 As use-values, commodities are, above all, of different qualities, but as exchange-values they are merely different quantities, and consequently do not contain an atom of use-value.

If then we leave out of consideration the use-value of commodities, they have only one common property left, that of being products of labour. But even the product of labour itself has undergone a change in our hands. If we make abstraction from its use-value, we make abstraction at the same time from the material elements and shapes that make the product a use-value; we see in it no longer a table, a house, yarn, or any other useful thing. Its existence as a material thing is put out of sight. Neither can it any longer be regarded as the product of the labour of the joiner, the mason, the spinner, or of any other definite kind of productive labour. Along with the useful qualities of the products themselves, we put out of sight both the useful character of the various kinds of labour embodied in them, and the concrete forms of that labour; there is nothing left but what is common to them all; all are reduced to one and the same sort of labour, human labour in the abstract.

Let us now consider the residue of each of these products; it consists of the same unsubstantial reality in each, a mere congelation of homogeneous human labour, of labour-power expended without regard to the mode of its expenditure. All that these things now tell us is, that human labour-power has been expended in their production, that human labour is embodied in them. When looked at as crystals of this social substance, common to them all, they are — Values.

We have seen that when commodities are exchanged, their exchange-value manifests itself as something totally independent of their use-value. But if we abstract from their use-value, there remains their Value as defined above. Therefore, the common substance that manifests itself in the exchange-value of commodities, whenever they are exchanged, is their value. The progress of our investigation will show that exchange-value is the only form in which the value of commodities can manifest itself or be expressed. For the present, however, we have to consider the nature of value independently of this, its form.

A use-value, or useful article, therefore, has value only because human labour in the abstract has been embodied or materialised in it. How, then, is the magnitude of this value to be measured? Plainly, by the quantity of the value-creating substance, the labour, contained in the article. The quantity of labour, however, is measured by its duration, and labour-time in its turn finds its standard in weeks, days, and hours.

Some people might think that if the value of a commodity is determined by the quantity of labour spent on it, the more idle and unskilful the labourer, the more valuable would his commodity be, because more time would be required in its production. The labour, however, that forms the substance of value, is homogeneous human labour, expenditure of one uniform labour-power. The total labour-power of society, which is embodied in the sum total of the values of all commodities produced by that society, counts here as one homogeneous mass of human labour-power, composed though it be of innumerable individual units. Each of these units is the same as any other, so far as it has the character of the average labour-power of society, and takes effect as such; that is, so far as it requires for producing a commodity, no more time than is needed on an average, no more than is socially necessary. The labour-time socially necessary is that required to produce an article under the normal conditions of production, and with the average degree of skill and intensity prevalent at the time. The introduction of power-looms into England probably reduced by one-half the labour required to weave a given quantity of yarn into cloth. The hand-loom weavers, as a matter of fact, continued to require the same time as before; but for all that, the product of one hour of their labour represented after the change only half an hour's social labour, and consequently fell to one-half its former value.

We see then that that which determines the magnitude of the value of any article is the amount of labour socially necessary, or the labour-time socially necessary for its production.9 Each individual commodity, in this connexion, is to be considered as an average sample of its class.10 Commodities, therefore, in which equal quantities of labour are embodied, or which can be produced in the same time, have the same value. The value of one commodity is to the value of any other, as the labour-time necessary for the production of the one is to that necessary for the production of the other. "As values, all commodities are only definite masses of congealed labour-time."11

The value of a commodity would therefore remain constant, if the labour-time required for its production also remained constant. But the latter changes with every variation in the productiveness of labour. This productiveness is determined by various circumstances, amongst others, by the average amount of skill of the workmen, the state of science, and the degree of its practical application, the social organisation of production, the extent and capabilities of the means of production, and by physical conditions. For example, the same amount of labour in favourable seasons is embodied in 8 bushels of corn, and in unfavourable, only in four. The same labour extracts from rich mines more metal than from poor mines. Diamonds are of very rare occurrence on the earth's surface, and hence their discovery costs, on an average, a great deal of labour-time. Consequently much labour is represented in a small compass. Jacob doubts whether gold has ever been paid for at its full value. This applies still more to diamonds. According to Eschwege, the total produce of the Brazilian diamond mines for the eighty years, ending in 1823, had not realised the price of one and-a-half years' average produce of the sugar and coffee plantations of the same country, although the diamonds cost much more labour, and therefore represented more value. With richer mines, the same quantity of labour would embody itself in more diamonds, and their value would fall. If we could succeed at a small expenditure of labour, in converting carbon into diamonds, their value might fall below that of bricks. In general, the greater the productiveness of labour, the less is the labour-time required for the production of an article, the less is the amount of labour crystallised in that article, and the less is its value; and vice versâ, the less the productiveness of labour, the greater is the labour-time required for the production of an article, and the greater is its value. The value of a commodity, therefore, varies directly as the quantity, and inversely as the productiveness, of the labour incorporated in it.

A thing can be a use-value, without having value. This is the case whenever its utility to man is not due to labour. Such are air, virgin soil, natural meadows, &c. A thing can be useful, and the product of human labour, without being a commodity. Whoever directly satisfies his wants with the produce of his own labour, creates, indeed, use-values, but not commodities. In order to produce the latter, he must not only produce use-values, but use-values for others, social use-values. (And not only for others, without more. The mediaeval peasant produced quit-rent-corn for his feudal lord and tithe-corn for his parson. But neither the quit-rent-corn nor the tithe-corn became commodities by reason of the fact that they had been produced for others. To become a commodity a product must be transferred to another, whom it will serve as a use-value, by means of an exchange.) Lastly nothing can have value, without being an object of utility. If the thing is useless, so is the labour contained in it; the labour does not count as labour, and therefore creates no value. |

|

1 - 1 - 1 -2 TwoFold Charater of Labour Embodied in Commodities 8.8 7:20.

At first sight a commodity presented itself to us as a complex of two things-use-value and exchange-value. Later on, we saw also that labour, too, possesses the same two-fold nature; for, so far as it finds expression in value, it does not possess the same characteristics that belong to it as a creator of use-values. I was the first to point out and to examine critically this two-fold nature of the labour contained in commodities. As this point is the pivot on which a clear comprehension of Political Economy turns, we must go more into detail.

Let us take two commodities such as a coat and 10 yards of linen, and let the former be double the value of the latter, so that, if 10 yards of linen = W, the coat = 2W.

The coat is a use-value that satisfies a particular want. Its existence is the result of a special sort of productive activity, the nature of which is determined by its aim, mode of operation, subject, means, and result. The labour, whose utility is thus represented by the value in use of its product, or which manifests itself by making its product a use-value, we call useful labour In this connexion we consider only its useful effect.

As the coat and the linen are two qualitatively different use-values, so also are the two forms of labour that produce them, tailoring and weaving. Were these two objects not qualitatively different, not produced respectively by labour of different quality, they could not stand to each other in the relation of commodities. Coats are not exchanged for coats, one use-value is not exchanged for another of the same kind.

To all the different varieties of values in use there correspond as many different kinds of useful labour, classified according to the order, genus, species, and variety to which they belong in the social division of labour. This division of labour is a necessary condition for the production of commodities, but it does not follow, conversely, that the production of commodities is a necessary condition for the division of labour. In the primitive Indian community there is social division of labour, without production of commodities. Or, to take an example nearer home, in every factory the labour is divided according to a system, but this division is not brought about by the operatives mutually exchanging their individual products. Only such products can become commodities with regard to each other, as result from different kinds of labour, each kind being carried on independently and for the account of private individuals.

To resume, then: In the use-value of each commodity there is contained useful labour, i.e., productive activity of a definite kind and exercised with a definite aim. Use-values cannot confront each other as commodities, unless the useful labour embodied in them is qualitatively different in each of them. In a community, the produce of which in general takes the form of commodities, i.e., in a community of commodity producers, this qualitative difference between the useful forms of labour that are carried on independently of individual producers, each on their own account, develops into a complex system, a social division of labour.

Anyhow, whether the coat be worn by the tailor or by his customer, in either case it operates as a use-value. Nor is the relation between the coat and the labour that produced it altered by the circumstance that tailoring may have become a special trade, an independent branch of the social division of labour. Wherever the want of clothing forced them to it, the human race made clothes for thousands of years, without a single man becoming a tailor. But coats and linen, like every other element of material wealth that is not the spontaneous produce of Nature, must invariably owe their existence to a special productive activity, exercised with a definite aim, an activity that appropriates particular nature-given materials to particular human wants. So far therefore as labour is a creator of use-value, is useful labour, it is a necessary condition, independent of all forms of society, for the existence of the human race; it is an eternal nature-imposed necessity, without which there can be no material exchanges between man and Nature, and therefore no life.

The use-values, coat, linen, &c., i.e., the bodies of commodities, are combinations of two elements — matter and labour. If we take away the useful labour expended upon them, a material substratum is always left, which is furnished by Nature without the help of man. The latter can work only as Nature does, that is by changing the form of matter. 12 Nay more, in this work of changing the form he is constantly helped by natural forces. We see, then, that labour is not the only source of material wealth, of use-values produced by labour. As William Petty puts it, labour is its father and the earth its mother.

Let us now pass from the commodity considered as a use-value to the value of commodities.

By our assumption, the coat is worth twice as much as the linen. But this is a mere quantitative difference, which for the present does not concern us. We bear in mind, however, that if the value of the coat is double that of 10 yds. of linen, 20 yds. of linen must have the same value as one coat. So far as they are values, the coat and the linen are things of a like substance, objective expressions of essentially identical labour. But tailoring and weaving are, qualitatively, different kinds of labour. There are, however, states of society in which one and the same man does tailoring and weaving alternately, in which case these two forms of labour are mere modifications of the labour of the same individual, and no special and fixed functions of different persons, just as the coat which our tailor makes one day, and the trousers which he makes another day, imply only a variation in the labour of one and the same individual. oreover, we see at a glance that, in our capitalist society, a given portion of human labour is, in accordance with the varying demand, at one time supplied in the form of tailoring, at another in the form of weaving. This change may possibly not take place without friction, but take place it must.

Productive activity, if we leave out of sight its special form, viz., the useful character of the labour, is nothing but the expenditure of human labour-power. Tailoring and weaving, though qualitatively different productive activities, are each a productive expenditure of human brains, nerves, and muscles, and in this sense are human labour. They are but two different modes of expending human labour-power. Of course, this labour-power, which remains the same under all its modifications, must have attained a certain pitch of development before it can be expended in a multiplicity of modes. But the value of a commodity represents human labour in the abstract, the expenditure of human labour in general. And just as in society, a general or a banker plays a great part, but mere man, on the other hand, a very shabby part 13 so here with mere human labour. It is the expenditure of simple labour-power, i.e., of the labour-power which, on an average, apart from any special development, exists in the organism of every ordinary individual. Simple average labour, it is true, varies in character in different countries and at different times, but in a particular society it is given. Skilled labour counts only as simple labour intensified, or rather, as multiplied simple labour, a given quantity of skilled being considered equal to a greater quantity of simple labour. Experience shows that this reduction is constantly being made. A commodity may be the product of the most skilled labour, but its value, by equating it to the product of simple unskilled labour, represents a definite quantity of the latter labour alone.14 The different proportions in which different sorts of labour are reduced to unskilled labour as their standard. are established by a social process that goes on behind the backs of the producers, and, consequently, appear to be fixed by custom. For simplicity's sake we shall henceforth account every kind of labour to be unskilled, simple labour; by this we do no more than save ourselves the trouble of making the reduction.

Just as, therefore, in viewing the coat and linen as values, we abstract from their different use-values, so it is with the labour represented by those values: we disregard the difference between its useful forms, weaving and tailoring. As the use-values, coat and linen, are combinations of special productive activities with cloth and yarn, while the values, coat and linen, are, on the other hand, mere homogeneous congelations of undifferentiated labour, so the labour embodied in these latter values does not count by virtue of its productive relation to cloth and yarn, but only as being expenditure of human labour-power. Tailoring and weaving are necessary factors in the creation of the use-values, coat and linen, precisely because these two kinds of labour are of different qualities; but only in so far as abstraction is made from their special qualities, only in so far as both possess the same quality of being human labour, do tailoring and weaving form the substance of the values of the same articles.

Coats and linen, however, are not merely values, but values of definite magnitude, and according to our assumption, the coat is worth twice as much as the ten yards of linen. Whence this difference in their values? It is owing to the fact that the linen contains only half as much labour as the coat, and consequently, that in the production of the latter, labour-power must have been expended during twice the time necessary for the production of the former.

While, therefore, with reference to use-value, the labour contained in a commodity counts only qualitatively, with reference to value it counts only quantitatively, and must first be reduced to human labour pure and simple. In the former case, it is a question of How and What, in the latter of How much? How long a time? Since the magnitude of the value of a commodity represents only the quantity of labour embodied in it, it follows that all commodities, when taken in certain proportions, must be equal in value.

If the productive power of all the different sorts of useful labour required for the production of a coat remains unchanged, the sum of the values of the coats produced increases with their number. If one coat represents x days' labour, two coats represent 2x days' labour, and so on. But assume that the duration of the labour necessary for he production of a coat becomes doubled or halved. In the first case one coat is worth as much as two coats were before; in the second case, two coats are only worth as much as one was before, although in both cases one coat renders the same service as before. and the useful labour embodied in it remains of the same quality. But the quantity of labour spent on its production has altered.

An increase in the quantity of use-values is an increase of material wealth. With two coats two men can be clothed, with one coat only one man. Nevertheless, an increased quantity of material wealth may correspond to a simultaneous fall in the magnitude of its value. This antagonistic movement has its origin in the two-fold character of labour. Productive power has reference, of course, only to labour of some useful concrete form, the efficacy of any special productive activity during a given time being dependent on its productiveness. Useful labour becomes, therefore, a more or less abundant source of products, in proportion to the rise or fall of its productiveness. On the other hand, no change in this productiveness affects the labour represented by value. Since productive power is an attribute of the concrete useful forms of labour, of course it can no longer have any bearing on that labour, so soon as we make abstraction from those concrete useful forms. However then productive power may vary, the same labour, exercised during equal periods of time, always yields equal amounts of value. But it will yield, during equal periods of time, different quantities of values in use; more, if the productive power rise, fewer, if it fall. The same change in productive power, which increases the fruitfulness of labour, and, in consequence, the quantity of use-values produced by that labour, will diminish the total value of this increased quantity of use-values, provided such change shorten the total labour-time necessary for their production; and vice versâ.

On the one hand all labour is, speaking physiologically, an expenditure of human labour-power, and in its character of identical abstract human labour, it creates and forms the value of commodities. On the other hand, all labour is the expenditure of human labour-power in a special form and with a definite aim, and in this, its character of concrete useful labour, it produces use-values. |

|

1 - 1 - 1 - 3 Form of Value or Exchange Value 54.2 45:10.

Commodities come into the world in the shape of use-values, articles, or goods, such as iron, linen, corn, &c. This is their plain, homely, bodily form. They are, however, commodities, only because they are something two-fold, both objects of utility, and, at the same time, depositories of value. They manifest themselves therefore as commodities, or have the form of commodities, only in so far as they have two forms, a physical or natural form, and a value-form.

The reality of the value of commodities differs in this respect from Dame Quickly, that we don't know "where to have it." The value of commodities is the very opposite of the coarse materiality of their substance, not an atom of matter enters into its composition. Turn and examine a single commodity, by itself, as we will, yet in so far as it remains an object of value, it seems impossible to grasp it. If, however we bear in mind that the value of commodities has a purely social reality, and that they acquire this reality only in so far as they are expressions or embodiments of one identical social substance, viz., human labour, it follows as a matter of course, that value can only manifest itself in the social relation of commodity to commodity. In fact we started from exchange-value, or the exchange relation of commodities, in order to get at the value that lies hidden behind it. We must now return to this form under which value first appeared to us.

Every one knows, if he knows nothing else, that commodities have a value-form common to them all, and presenting a marked contrast with the varied bodily forms of their use-values. I mean their money-form. Here, however, a task is set us, the performance of which has never yet even been attempted by bourgeois economy, the task of tracing the genesis of this money-form, of developing the expression of value implied in the value-relation of commodities, from its simplest, almost imperceptible outline, to the dazzling money-form. By doing this we shall, at the same time, solve the riddle presented by money.

The simplest value-relation is evidently that of one commodity to some one other commodity of a different kind. Hence the relation between the values of two commodities supplies us with the simplest expression of the value of a single commodity.

A. Elementary or Accidental Form Of Value

x commodity A = y commodity B, or

x commodity A is worth y commodity B.

20 yards of linen = 1 coat, or

20 Yards of linen are worth 1 coat.

1. The two poles of the expression of value. Relative form and Equivalent form

The whole mystery of the form of value lies hidden in this elementary form. Its analysis, therefore, is our real difficulty.

Here two different kinds of commodities (in our example the linen and the coat), evidently play two different parts. The linen expresses its value in the coat; the coat serves as the material in which that value is expressed. The former plays an active, the latter a passive, part. The value of the linen is represented as relative value, or appears in relative form. The coat officiates as equivalent, or appears in equivalent form.

The relative form and the equivalent form are two intimately connected, mutually dependent and inseparable elements of the expression of value; but, at the same time, are mutually exclusive, antagonistic extremes — i.e., poles of the same expression. They are allotted respectively to the two different commodities brought into relation by that expression. It is not possible to express the value of linen in linen. 20 yards of linen = 20 yards of linen is no expression of value. On the contrary, such an equation merely says that 20 yards of linen are nothing else than 20 yards of linen, a definite quantity of the use-value linen. The value of the linen can therefore be expressed only relatively — i.e., in some other commodity. The relative form of the value of the linen pre-supposes, therefore, the presence of some other commodity — here the coat — under the form of an equivalent. On the other hand, the commodity that figures as the equivalent cannot at the same time assume the relative form. That second commodity is not the one whose value is expressed. Its function is merely to serve as the material in which the value of the first commodity is expressed.

No doubt, the expression 20 yards of linen = 1 coat, or 20 yards of linen are worth 1 coat, implies the opposite relation. 1 coat = 20 yards of linen, or 1 coat is worth 20 yards of linen. But, in that case, I must reverse the equation, in order to express the value of the coat relatively; and. so soon as I do that the linen becomes the equivalent instead of the coat. A single commodity cannot, therefore, simultaneously assume, in the same expression of value, both forms. The very polarity of these forms makes them mutually exclusive.

Whether, then, a commodity assumes the relative form, or the opposite equivalent form, depends entirely upon its accidental position in the expression of value — that is, upon whether it is the commodity whose value is being expressed or the commodity in which value is being expressed.

2. The Relative Form of value

(a.) The nature and import of this form

In order to discover how the elementary expression of the value of a commodity lies hidden in the value-relation of two commodities, we must, in the first place, consider the latter entirely apart from its quantitative aspect. The usual mode of procedure is generally the reverse, and in the value-relation nothing is seen but the proportion between definite quantities of two different sorts of commodities that are considered equal to each other. It is apt to be forgotten that the magnitudes of different things can be compared quantitatively, only when those magnitudes are expressed in terms of the same unit. It is only as expressions of such a unit that they are of the same denomination, and therefore commensurable.17

Whether 20 yards of linen = 1 coat or = 20 coats or = x coats-that is, whether a given quantity of linen is worth few or many coats, every such statement implies that the linen and coats, as magnitudes of value, are expressions of the same unit, things of the same kind. Linen = coat is the basis of the equation.

But the two commodities whose identity of quality is thus assumed, do not play the same part. It is only the value of the linen that is expressed. And how? By its reference to the coat as its equivalent, as something that can be exchanged for it. In this relation the coat is the mode of existence of value, is value embodied, for only as such is it the same as the linen. On the other hand, the linen's own value comes to the front, receives independent expression, for it is only as being value that it is comparable with the coat as a thing of equal value, or exchangeable with the coat. To borrow an illustration from chemistry, butyric acid is a different substance from propyl formate. Yet both are made up of the same chemical substances, carbon (C), hydrogen (H), and oxygen (O), and that, too, in like proportions — namely, C4H8O2. If now we equate butyric acid to propyl formate, then, in the first place, propyl formate would be, in this relation, merely a form of existence of C4H8O2; and in the second place, we should be stating that butyric acid also consists of C4H8O2. Therefore, by thus equating the two substances, expression would be given to their chemical composition, while their different physical forms would be neglected.

If we say that, as values, commodities are mere congelations of human labour, we reduce them by our analysis, it is true, to the abstraction, value; but we ascribe to this value no form apart from their bodily form. It is otherwise in the value-relation of one commodity to another. Here, the one stands forth in its character of value by reason of its relation to the other.

By making the coat the equivalent of the linen, we equate the labour embodied in the former to that in the latter. Now, it is true that the tailoring, which makes the coat, is concrete labour of a different sort from the weaving which makes the linen. But the act of equating it to the weaving, reduces the tailoring to that which is really equal in the two kinds of labour, to their common character of human labour. In this roundabout way, then, the fact is expressed, that weaving also, in so far as it weaves value, has nothing to distinguish it from tailoring, and, consequently, is abstract human labour. It is the expression of equivalence between different sorts of commodities that alone brings into relief the specific character of value-creating labour, and this it does by actually reducing the different varieties of labour embodied in the different kinds of commodities to their common quality of human labour in the abstract.

There is, however, something else required beyond the expression of the specific character of the labour of which the value of the linen consists. Human labour-power in motion, or human labour, creates value, but is not itself value. It becomes value only in its congealed state, when embodied in the form of some object. In order to express the value of the linen as a congelation of human labour, that value must be expressed as having objective existence, as being a something materially different from the linen itself, and yet a something common to the linen and all other commodities. The problem is already solved.

When occupying the position of equivalent in the equation of value, the coat ranks qualitatively as the equal of the linen, as something of the same kind, because it is value. In this position it is a thing in which we see nothing but value, or whose palpable bodily form represents value. Yet the coat itself, the body of the commodity, coat, is a mere use-value. A coat as such no more tells us it is value, than does the first piece of linen we take hold of. This shows that when placed in value-relation to the linen, the coat signifies more than when out of that relation, just as many a man strutting about in a gorgeous uniform counts for more than when in mufti.

In the production of the coat, human labour-power, in the shape of tailoring, must have been actually expended. Human labour is therefore accumulated in it. In this aspect the coat is a depository of value, but though worn to a thread, it does not let this fact show through. And as equivalent of the linen in the value equation, it exists under this aspect alone, counts therefore as embodied value, as a body that is value. A, for instance, cannot be "your majesty" to B, unless at the same time majesty in B's eyes assumes the bodily form of A, and, what is more, with every new father of the people, changes its features, hair, and many other things besides.

Hence, in the value equation, in which the coat is the equivalent of the linen, the coat officiates as the form of value. The value of the commodity linen is expressed by the bodily form of the commodity coat, the value of one by the use-value of the other. As a use-value, the linen is something palpably different from the coat; as value, it is the same as the coat, and now has the appearance of a coat. Thus the linen acquires a value-form different from its physical form. The fact that it is value, is made manifest by its equality with the coat, just as the sheep's nature of a Christian is shown in his resemblance to the Lamb of God.

We see, then, all that our analysis of the value of commodities has already told us, is told us by the linen itself, so soon as it comes into communication with another commodity, the coat. Only it betrays its thoughts in that language with which alone it is familiar, the language of commodities. In order to tell us that its own value is created by labour in its abstract character of human labour, it says that the coat, in so far as it is worth as much as the linen, and therefore is value, consists of the same labour as the linen. In order to inform us that its sublime reality as value is not the same as its buckram body, it says that value has the appearance of a coat, and consequently that so far as the linen is value, it and the coat are as like as two peas. We may here remark, that the language of commodities has, besides Hebrew, many other more or less correct dialects. The German "Wertsein," to be worth, for instance, expresses in a less striking manner than the Romance verbs "valere," "valer," "valoir," that the equating of commodity B to commodity A, is commodity A's own mode of expressing its value. Paris vaut bien une messe.

By means, therefore, of the value-relation expressed in our equation, the bodily form of commodity B becomes the value-form of commodity A, or the body of commodity B acts as a mirror to the value of commodity A.19 By putting itself in relation with commodity B, as value in propriâ personâ, as the matter of which human labour is made up, the commodity A converts the value in use, B, into the substance in which to express its, A's, own value. The value of A, thus expressed in the use-value of B, has taken the form of relative value.

(b.) Quantitative determination of Relative value

Every commodity, whose value it is intended to express, is a useful object of given quantity, as 15 bushels of corn, or 100 Ibs. of coffee. And a given quantity of any commodity contains a definite quantity of human labour. The value-form must therefore not only express value generally, but also value in definite quantity. Therefore, in the value-relation of commodity A to commodity B, of the linen to the coat, not only is the latter, as value in general, made the equal in quality of the linen, but a definite quantity of coat (1 coat) is made the equivalent of a definite quantity (20 yards) of linen.

The equation, 20 yards of linen = 1 coat, or 20 yards of linen are worth one coat, implies that the same quantity of value-substance (congealed labour) is embodied in both; that the two commodities have each cost the same amount of labour of the same quantity of labour-time. But the labour-time necessary for the production of 20 yards of linen or 1 coat varies with every change in the productiveness of weaving or tailoring. We have now to consider the influence of such changes on the quantitative aspect of the relative expression of value.

I. Let the value of the linen vary,20 that of the coat remaining constant. If, say in consequence of the exhaustion of flax-growing soil, the labour-time necessary for the production of the linen be doubled, the value of the linen will also be doubled. Instead of the equation, 20 yards of linen = 1 coat, we should have 20 yards of linen = 2 coats, since 1 coat would now contain only half the labour-time embodied in 20 yards of linen. If, on the other hand, in consequence, say, of improved looms, this labour-time be reduced by one-half, the value of the linen would fall by one-half. Consequently, we should have 20 yards of linen = 1/2 coat. The relative value of commodity A, i.e., its value expressed in commodity B, rises and falls directly as the value of A, the value of B being supposed constant.

II. Let the value of the linen remain constant, while the value of the coat varies. If, under these circumstances, in consequence, for instance, of a poor crop of wool, the labour-time necessary for the production of a coat becomes doubled, we have instead of 20 yards of linen = 1 coat, 20 yards of linen = 1/2 coat. If, on the other hand, the value of the coat sinks by one-half, then 20 yards of linen = 2 coats. Hence, if the value of commodity A remain constant, its relative value expressed in commodity B rises and falls inversely as the value of B.

If we compare the different cases in I. and II., we see that the same change of magnitude in relative value may arise from totally opposite causes. Thus, the equation, 20 yards of linen = 1 coat, becomes 20 yards of linen = 2 coats, either, because the value of the linen has doubled, or because the value of the coat has fallen by one-half; and it becomes 20 yards of linen = 1/2 coat, either, because the value of the linen has fallen by one-half, or because the value of the coat has doubled.

III. Let the quantities of labour-time respectively necessary for the production of the linen and the coat vary simultaneously in the same direction and in the same proportion. In this case 20 yards of linen continue equal to 1 coat, however much their values may have altered. Their change of value is seen as soon as they are compared with a third commodity, whose value has remained constant. If the values of all commodities rose or fell simultaneously, and in the same proportion, their relative values would remain unaltered. Their real change of value would appear from the diminished or increased quantity of commodities produced in a given time.

IV. The labour-time respectively necessary for the production of the linen and the coat, and therefore the value of these commodities may simultaneously vary in the same direction, but at unequal rates or in opposite directions, or in other ways. The effect of all these possible different variations, on the relative value of a commodity, may be deduced from the results of I., II., and III.

Thus real changes in the magnitude of value are neither unequivocally nor exhaustively reflected in their relative expression, that is, in the equation expressing the magnitude of relative value. The relative value of a commodity may vary, although its value remains constant. Its relative value may remain constant, although its value varies; and finally, simultaneous variations in the magnitude of value and in that of its relative expression by no means necessarily correspond in amount.21

3. The Equivalent form of value

We have seen that commodity A (the linen), by expressing its value in the use-value of a commodity differing in kind (the coat), at the same time impresses upon the latter a specific form of value, namely that of the equivalent. The commodity linen manifests its quality of having a value by the fact that the coat, without having assumed a value-form different from its bodily form, is equated to the linen. The fact that the latter therefore has a value is expressed by saying that the coat is directly exchangeable with it. Therefore, when we say that a commodity is in the equivalent form, we express the fact that it is directly exchangeable with other commodities.

When one commodity, such as a coat, serves as the equivalent of another, such as linen, and coats consequently acquire the characteristic property of being directly exchangeable with linen, we are far from knowing in what proportion the two are exchangeable. The value of the linen being given in magnitude, that proportion depends on the value of the coat. Whether the coat serves as the equivalent and the linen as relative value, or the linen as the equivalent and the coat as relative value, the magnitude of the coat's value is determined, independently of its value-form, by the labour-time necessary for its production. But whenever the coat assumes in the equation of value, the position of equivalent, its value acquires no quantitative expression; on the contrary, the commodity coat now figures only as a definite quantity of some article.

For instance, 40 yards of linen are worth — what? 2 coats. Because the commodity coat here plays the part of equivalent, because the use-value coat, as opposed to the linen, figures as an embodiment of value, therefore a definite number of coats suffices to express the definite quantity of value in the linen. Two coats may therefore express the quantity of value of 40 yards of linen, but they can never express the quantity of their own value. A superficial observation of this fact, namely, that in the equation of value, the equivalent figures exclusively as a simple quantity of some article, of some use-value, has misled Bailey, as also many others, both before and after him, into seeing, in the expression of value, merely a quantitative relation. The truth being, that when a commodity acts as equivalent, no quantitative determination of its value is expressed.

The first peculiarity that strikes us, in considering the form of the equivalent, is this: use-value becomes the form of manifestation, the phenomenal form of its opposite, value.

The bodily form of the commodity becomes its value-form. But, mark well, that this quid pro quo exists in the case of any commodity B, only when some other commodity A enters into a value-relation with it, and then only within the limits of this relation. Since no commodity can stand in the relation of equivalent to itself, and thus turn its own bodily shape into the expression of its own value, every commodity is compelled to choose some other commodity for its equivalent, and to accept the use-value, that is to say, the bodily shape of that other commodity as the form of its own value.

One of the measures that we apply to commodities as material substances, as use-values, will serve to illustrate this point. A sugar-loaf being a body, is heavy, and therefore has weight: but we can neither see nor touch this weight. We then take various pieces of iron, whose weight has been determined beforehand. The iron, as iron, is no more the form of manifestation of weight, than is the sugar-loaf. Nevertheless, in order to express the sugar-loaf as so much weight, we put it into a weight-relation with the iron. In this relation, the iron officiates as a body representing nothing but weight. A certain quantity of iron therefore serves as the measure of the weight of the sugar, and represents, in relation to the sugar-loaf, weight embodied, the form of manifestation of weight. This part is played by the iron only within this relation, into which the sugar or any other body, whose weight has to be determined, enters with the iron. Were they not both heavy, they could not enter into this relation, and the one could therefore not serve as the expression of the weight of the other. When we throw both into the scales, we see in reality, that as weight they are both the same, and that, therefore, when taken in proper proportions, they have the same weight. Just as the substance iron, as a measure of weight, represents in relation to the sugar-loaf weight alone, so, in our expression of value, the material object, coat, in relation to the linen, represents value alone.

Here, however, the analogy ceases. The iron, in the expression of the weight of the sugar-loaf, represents a natural property common to both bodies, namely their weight; but the coat, in the expression of value of the linen, represents a non-natural property of both, something purely social, namely, their value.

Since the relative form of value of a commodity — the linen, for example — expresses the value of that commodity, as being something wholly different from its substance and properties, as being, for instance, coat-like, we see that this expression itself indicates that some social relation lies at the bottom of it. With the equivalent form it is just the contrary. The very essence of this form is that the material commodity itself — the coat — just as it is, expresses value, and is endowed with the form of value by Nature itself. Of course this holds good only so long as the value-relation exists, in which the coat stands in the position of equivalent to the linen.22 Since, however, the properties of a thing are not the result of its relations to other things, but only manifest themselves in such relations, the coat seems to be endowed with its equivalent form, its property of being directly exchangeable, just as much by Nature as it is endowed with the property of being heavy, or the capacity to keep us warm. Hence the enigmatical character of the equivalent form which escapes the notice of the bourgeois political economist, until this form, completely developed, confronts him in the shape of money. He then seeks to explain away the mystical character of gold and silver, by substituting for them less dazzling commodities, and by reciting, with ever renewed satisfaction, the catalogue of all possible commodities which at one time or another have played the part of equivalent. He has not the least suspicion that the most simple expression of value, such as 20 yds. of linen = 1 coat, already propounds the riddle of the equivalent form for our solution.

The body of the commodity that serves as the equivalent, figures as the materialisation of human labour in the abstract, and is at the same time the product of some specifically useful concrete labour. This concrete labour becomes, therefore, the medium for expressing abstract human labour. If on the one hand the coat ranks as nothing but the embodiment of abstract human labour, so, on the other hand, the tailoring which is actually embodied in it, counts as nothing but the form under which that abstract labour is realised. In the expression of value of the linen, the utility of the tailoring consists, not in making clothes, but in making an object, which we at once recognise to be Value, and therefore to be a congelation of labour, but of labour indistinguishable from that realised in the value of the linen. In order to act as such a mirror of value, the labour of tailoring must reflect nothing besides its own abstract quality of being human labour generally.

In tailoring, as well as in weaving, human labour-power is expended. Both, therefore, possess the general property of being human labour, and may, therefore, in certain cases, such as in the production of value, have to be considered under this aspect alone. There is nothing mysterious in this. But in the expression of value there is a complete turn of the tables. For instance, how is the fact to be expressed that weaving creates the value of the linen, not by virtue of being weaving, as such, but by reason of its general property of being human labour? Simply by opposing to weaving that other particular form of concrete labour (in this instance tailoring), which produces the equivalent of the product of weaving. Just as the coat in its bodily form became a direct expression of value, so now does tailoring, a concrete form of labour, appear as the direct and palpable embodiment of human labour generally.

Hence, the second peculiarity of the equivalent form is, that concrete labour becomes the form under which its opposite, abstract human labour, manifests itself.

But because this concrete labour, tailoring in our case, ranks as, and is directly identified with, undifferentiated human labour, it also ranks as identical with any other sort of labour, and therefore with that embodied in the linen. Consequently, although, like all other commodity producing labour, it is the labour of private individuals, yet, at the same time, it ranks as labour directly social in its character. This is the reason why it results in a product directly exchangeable with other commodities. We have then a third peculiarity of the equivalent form, namely, that the labour of private individuals takes the form of its opposite, labour directly social in its form.

The two latter peculiarities of the equivalent form will become more intelligible if we go back to the great thinker who was the first to analyse so many forms, whether of thought, society, or Nature, and amongst them also the form of value. I mean Aristotle.

In the first place, he clearly enunciates that the money-form of commodities is only the further development of the simple form of value-i.e., of the expression of the value of one commodity in some other commodity taken at random; for he says -- ;:

5 beds = 1 house ) is not to be

distinguished from

5 beds = so much money.

)

He further sees that the value-relation which gives rise to this expression makes it necessary that the house should qualitatively be made the equal of the bed, and that, without such an equalisation, these two clearly different things could not be compared with each other as commensurable quantities. "Exchange," he says, "cannot take place without equality, and equality not without commensurability". (). Here, however, he comes to a stop, and gives up the further analysis of the form of value. "It is, however, in reality, impossible ), that such unlike things can be commensurable" — i.e., qualitatively equal. Such an equalisation can only be something foreign to their real nature, consequently only "a makeshift for practical purposes."

Aristotle therefore, himself, tells us, what barred the way to his further analysis; it was the absence of any concept of value. What is that equal something, that common substance, which admits of the value of the beds being expressed by a house? Such a thing, in truth, cannot exist, says Aristotle. And why not? Compared with the beds, the house does represent something equal to them, in so far as it represents what is really equal, both in the beds and the house. And that is — human labour.

There was, however, an important fact which prevented Aristotle from seeing that, to attribute value to commodities, is merely a mode of expressing all labour as equal human labour, and consequently as labour of equal quality. Greek society was founded upon slavery, and had, therefore, for its natural basis, the inequality of men and of their labour-powers. The secret of the expression of value, namely, that all kinds of labour are equal and equivalent, because, and so far as they are human labour in general, cannot be deciphered, until the notion of human equality has already acquired the fixity of a popular prejudice. This, however, is possible only in a society in which the great mass of the produce of labour takes the form of commodities, in which, consequently, the dominant relation between man and man, is that of owners of commodities. The brilliancy of Aristotle's genius is shown by this alone, that he discovered, in the expression of the value of commodities, a relation of equality. The peculiar conditions of the society in which he lived, alone prevented him from discovering what, "in truth," was at the bottom of this equality.

4. The Elementary Form of value considered as a whole

The elementary form of value of a commodity is contained in the equation, expressing its value-relation to another commodity of a different kind, or in its exchange-relation to the-same. The value of commodity A, is qualitatively expressed, by the fact that commodity B is directly exchangeable with it. Its value is quantitatively expressed by the fact, that a definite quantity of B is exchangeable with a definite quantity of A. In other words, the value of a commodity obtains independent and definite expression, by taking the form of exchange-value. When, at the beginning of this chapter, we said, in common parlance, that a commodity is both a use-value and an exchange-value, we were, accurately speaking, wrong. A commodity is a use-value or object of utility, and a value. It manifests itself as this two-fold thing, that it is, as soon as its value assumes an independent form — viz., the form of exchange-value. It never assumes this form when isolated, but only when placed in a value or exchange relation with another commodity of a different kind. When once we know this, such a mode of expression does no harm; it simply serves as an abbreviation.

Our analysis has shown, that the form or expression of the value of a commodity originates in the nature of value, and not that value and its magnitude originate in the mode of their expression as exchange-value. This, however, is the delusion as well of the mercantilists and their recent revivers, Ferrier, Ganilh,23 and others, as also of their antipodes, the modern bagmen of Free-trade, such as Bastiat. The mercantilists lay special stress on the qualitative aspect of the expression of value, and consequently on the equivalent form of commodities, which attains its full perfection in money. The modern hawkers of Free-trade, who must get rid of their article at any price, on the other hand, lay most stress on the quantitative aspect of the relative form of value. For them there consequently exists neither value, nor magnitude of value, anywhere except in its expression by means of the exchange relation of commodities, that is, in the daily list of prices current. Macleod, who has taken upon himself to dress up the confused ideas of Lombard Street in the most learned finery, is a successful cross between the superstitious mercantilists, and the enlightened Free-trade bagmen.

A close scrutiny of the expression of the value of A in terms of B, contained in the equation expressing the value-relation of A to B, has shown us that, within that relation, the bodily form of A figures only as a use-value, the bodily form of B only as the form or aspect of value. The opposition or contrast existing internally in each commodity between use-value and value, is, therefore, made evident externally by two commodities being placed in such relation to each other, that the commodity whose value it is sought to express, figures directly as a mere use-value, while the commodity in which that value is to be expressed, figures directly as mere exchange-value. Hence the elementary form of value of a commodity is the elementary form in which the contrast contained in that commodity, between use-value and value, becomes apparent.

Every product of labour is, in all states of society, a use-value; but it is only at a definite historical epoch in a society's development that such a product becomes a commodity, viz., at the epoch when the labour spent on the production of a useful article becomes expressed as one of the objective qualities of that article, i.e., as its value. It therefore follows that the elementary value-form is also the primitive form under which a product of labour appears historically as a commodity, and that the gradual transformation of such products into commodities, proceeds pari passu with the development of the value-form.

We perceive, at first sight, the deficiencies of the elementary form of value: it is a mere germ, which must undergo a series of metamorphoses before it can ripen into the price-form.

The expression of the value of commodity A in terms of any other commodity B, merely distinguishes the value from the use-value of A, and therefore places A merely in a relation of exchange with a single different commodity, B; but it is still far from expressing A's qualitative equality, and quantitative proportionality, to all commodities. To the elementary relative value-form of a commodity, there corresponds the single equivalent form of one other commodity. Thus, in the relative expression of value of the linen, the coat assumes the form of equivalent, or of being directly exchangeable, only in relation to a single commodity, the linen.

Nevertheless, the elementary form of value passes by an easy transition into a more complete form. It is true that by means of the elementary form, the value of a commodity A, becomes expressed in terms of one, and only one, other commodity. But that one may be a commodity of any kind, coat, iron, corn, or anything else. Therefore, according as A is placed in relation with one or the other, we get for one and the same commodity, different elementary expressions of value.24 The number of such possible expressions is limited only by the number of the different kinds of commodities distinct from it. The isolated expression of A's value, is therefore convertible into a series, prolonged to any length, of the different elementary expressions of that value.

B. Total or Expanded Form of value

Com. A=u Com. B or=v Com. C or=w Com. D or=x Com. E or=&c.

(20 byards of linen=1 coat or=10 lb tea or=40 lb coffee or=1 quarter corn or=2 ounces gold or=1/2 ton iron or=&c.)

1. The Expanded Relative form of value

The value of a single commodity, the linen, for example, is now expressed in terms of numberless other elements of the world of commodities. Every other commodity now becomes a mirror of the linen's value.25 It is thus, that for the first time, this value shows itself in its true light as a congelation of undifferentiated human labour. For the labour that creates it, now stands expressly revealed, as labour that ranks equally with every other sort of human labour, no matter what its form, whether tailoring, ploughing, mining, &c., and no matter, therefore, whether it is realised in coats, corn, iron, or gold. The linen, by virtue of the form of its value, now stands in a social relation, no longer with only one other kind of commodity, but with the whole world of commodities. As a commodity, it is a citizen of that world. At the same time, the interminable series of value equations implies, that as regards the value of a commodity, it is a matter of indifference under what particular form, or kind, of use-value it appears.

In the first form, 20 yds. of linen = 1 coat, it might, for ought that otherwise appears, be pure accident, that these two commodities are exchangeable in definite quantities. In the second form, on the contrary, we perceive at once the background that determines, and is essentially different from, this accidental appearance. The value of the linen remains unaltered in magnitude, whether expressed in coats, coffee, or iron, or in numberless different commodities, the property of as many different owners. The accidental relation between two individual commodity-owners disappears. It becomes plain, that it is not the exchange of commodities which regulates the magnitude of their value; but, on the contrary, that it is the magnitude of their value which controls their exchange proportions.

2. The particular Equivalent form

Each commodity, such as, coat, tea, corn, iron, &c., figures in the expression of value of the linen, as an equivalent, and, consequently, as a thing that is value. The bodily form of each of these commodities figures now as a particular equivalent form, one out of many. In the same way the manifold concrete useful kinds of labour, embodied in these different commodities, rank now as so many different forms of the realisation, or manifestation, of undifferentiated human labour.

3. Defects of the Total or Expanded form of value

In the first place, the relative expression of value is incomplete because the series representing it is interminable. The chain of which each equation of value is a link, is liable at any moment to be lengthened by each new kind of commodity that comes into existence and furnishes the material for a fresh expression of value. In the second place, it is a many-coloured mosaic of disparate and independent expressions of value. And lastly, if, as must be the case, the relative value of each commodity in turn, becomes expressed in this expanded form, we get for each of them a relative value-form, different in every case, and consisting of an interminable series of expressions of value. The defects of the expanded relative value-form are reflected in the corresponding equivalent form. Since the bodily form of each single commodity is one particular equivalent form amongst numberless others, we have, on the whole, nothing but fragmentary equivalent forms, each excluding the others. In the same way, also, the special, concrete, useful kind of labour embodied in each particular equivalent, is presented only as a particular kind of labour, and therefore not as an exhaustive representative of human labour generally. The latter, indeed, gains adequate manifestation in the totality of its manifold, particular, concrete forms. But, in that case, its expression in an infinite series is ever incomplete and deficient in unity.

The expanded relative value-form is, however, nothing but the sum of the elementary relative expressions or equations of the first kind, such as:

20 yards of linen = 1 coat 20 yards of linen = 10 Ibs. of tea, etc.

Each of these implies the corresponding inverted equation,

1 coat = 20 yards of linen 10 Ibs. of tea = 20 yards of linen, etc.

In fact, when a person exchanges his linen for many other commodities, and thus expresses its value in a series of other commodities, it necessarily follows, that the various owners of the latter exchange them for the linen, and consequently express the value of their various commodities in one and the same third commodity, the linen. If then, we reverse the series, 20 yards of linen = 1 coat or = 10 Ibs. of tea, etc., that is to say, if we give expression to the converse relation already implied in the series, we get,

C. The General Form of Value

1 coat

10 lbs. of tea

40 lbs. of coffee

1 quarter of corn

2 ounces of gold

1/2 a ton of iron

x com. A., etc |

= 20 yards of linen

|

1. The altered character of the form of value

All commodities now express their value (1) in an elementary form, because in a single commodity; (2) with unity, because in one and the same commodity. This form of value is elementary and the same for all, therefore general.

The forms A and B were fit only to express the value of a commodity as something distinct from its use-value or material form.

The first-form, A, furnishes such equations as the following: -- 1 coat = 20 yards of linen, 10 lbs. of tea = 1/2 ton of iron. The value of the coat is equated to linen, that of the tea to iron. But to be equated to linen, and again to iron, is to be as different as are linen and iron. This forms it is plain, occurs practically only in the first beginning, when the products of labour are converted into commodities by accidental and occasional exchanges.

The second form, B, distinguishes, in a more adequate manner than the first, the value of a commodity from its use-value, for the value of the coat is there placed in contrast under all possible shapes with the bodily form of the coat; it is equated to linen, to iron, to tea, in short, to everything else, only not to itself, the coat. On the other hand, any general expression of value common to all is directly excluded; for, in the equation of value of each commodity, all other commodities now appear only under the form of equivalents. The expanded form of value comes into actual existence for the first time so soon as a particular product of labour, such as cattle, is no longer exceptionally, but habitually, exchanged for various other commodities.

The third and lastly developed form expresses the values of the whole world of commodities in terms of a single commodity set apart for the purpose, namely, the linen, and thus represents to us their values by means of their equality with linen. The value of every commodity is now, by being equated to linen, not only differentiated from its own use-value, but from all other use-values generally, and is, by that very fact, expressed as that which is common to all commodities. By this form, commodities are, for the first time, effectively brought into relation with one another as values, or made to appear as exchange-values.

The two earlier forms either express the value of each commodity in terms of a single commodity of a different kind, or in a series of many such commodities. In both cases, it is, so to say, the special business of each single commodity to find an expression for its value, and this it does without the help of the others. These others, with respect to the former, play the passive parts of equivalents. The general form of value, C, results from the joint action of the whole world of commodities, and from that alone. A commodity can acquire a general expression of its value only by all other commodities, simultaneously with it, expressing their values in the same equivalent; and every new commodity must follow suit. It thus becomes evident that since the existence of commodities as values is purely social, this social existence can be expressed by the totality of their social relations alone, and consequently that the form of their value must be a socially recognised form.

All commodities being equated to linen now appear not only as qualitatively equal as values generally, but also as values whose magnitudes are capable of comparison. By expressing the magnitudes of their values in one and the same material, the linen, those magnitudes are also compared with each other For instance, 10 Ibs. of tea = 20 yards of linen, and 40 lbs. of coffee = 20 yards of linen. Therefore, 10 Ibs of tea = 40 Ibs. of coffee. In other words, there is contained in 1 lb. of coffee only one-fourth as much substance of value — labour — as is contained in 1 lb. of tea.

The general form of relative value, embracing the whole world of commodities, converts the single commodity that is excluded from the rest, and made to play the part of equivalent — here the linen — into the universal equivalent. The bodily form of the linen is now the form assumed in common by the values of all commodities; it therefore becomes directly exchangeable with all and every of them. The substance linen becomes the visible incarnation, the social chrysalis state of every kind of human labour. Weaving, which is the labour of certain private individuals producing a particular article, linen, acquires in consequence a social character, the character of equality with all other kinds of labour. The innumerable equations of which the general form of value is composed, equate in turn the labour embodied in the linen to that embodied in every other commodity, and they thus convert weaving into the general form of manifestation of undifferentiated human labour. In this manner the labour realised in the values of commodities is presented not only under its negative aspect, under which abstraction is made from every concrete form and useful property of actual work, but its own positive nature is made to reveal itself expressly. The general value-form is the reduction of all kinds of actual labour to their common character of being human labour generally, of being the expenditure of human labour-power.

The general value-form, which represents all products of labour as mere congelations of undifferentiated human labour, shows by its very structure that it is the social resume of the world of commodities. That form consequently makes it indisputably evident that in the world of commodities the character possessed by all labour of being human labour constitutes its specific social character.

2. The Interdependent Development of the Relative Form of Value, and of the Equivalent Form

The degree of development of the relative form of value corresponds to that of the equivalent form. But we must bear in mind that the development of the latter is only the expression and result of the development of the former.

The primary or isolated relative form of value of one commodity converts some other commodity into an isolated equivalent. The expanded form of relative value, which is the expression of the value of one commodity in terms of all other commodities, endows those other commodities with the character of particular equivalents differing in kind. And lastly, a particular kind of commodity acquires the character of universal equivalent, because all other commodities make it the material in which they uniformly express their value.

The antagonism between the relative form of value and the equivalent form, the two poles of the value-form, is developed concurrently with that form itself.

The first form, 20 yds. of linen = one coat, already contains this antagonism, without as yet fixing it. According as we read this equation forwards or backwards, the parts played by the linen and the coat are different. In the one case the relative value of the linen is expressed in the coat, in the other case the relative value of the coat is expressed in the linen. In this first form of value, therefore, it is difficult to grasp the polar contrast.

Form B shows that only one single commodity at a time can completely expand its relative value, and that it acquires this expanded form only because, and in so far as, all other commodities are, with respect to it, equivalents. Here we cannot reverse the equation, as we can the equation 20 yds. of linen = 1 coat, without altering its general character, and converting it from the expanded form of value into the general form of value.

Finally, the form C gives to the world of commodities a general social relative form of value, because, and in so far as, thereby all commodities, with the exception of one, are excluded from the equivalent form. A single commodity, the linen, appears therefore to have acquired the character of direct exchangeability with every other commodity because, and in so far as, this character is denied to every other commodity.26

The commodity that figures as universal equivalent, is, on the other hand, excluded from the relative value-form. If the linen, or any other commodity serving as universal equivalent, were, at the same time, to share in the relative form of value, it would have to serve as its own equivalent. We should then have 20 yds. of linen = 20 yds. of linen; this tautology expresses neither value, nor magnitude of value. In order to express the relative value of the universal equivalent, we must rather reverse the form C. This equivalent has no relative form of value in common with other commodities, but its value is relatively expressed by a never ending series of other commodities.

Thus, the expanded form of relative value, or form B, now shows itself as the specific form of relative value for the equivalent commodity.

3. Transition from the General Form of Value to the Money-Form

The universal equivalent form is a form of value in general. It can, therefore, be assumed by any commodity. On the other hand, if a commodity be found to have assumed the universal equivalent form (form C), this is only because and in so far as it has been excluded from the rest of all other commodities as their equivalent, and that by their own act. And from the moment that this exclusion becomes finally restricted to one particular commodity, from that moment only, the general form of relative value of the world of commodities obtains real consistence and general social validity.

The particular commodity, with whose bodily form the equivalent form is thus socially identified, now becomes the money-commodity, or serves as money. It becomes the special social function of that commodity, and consequently its social monopoly, to play within the world of commodities the part of the universal equivalent. Amongst the commodities which, in form B, figure as particular equivalents of the linen, and, in form C, express in common their relative values in linen, this foremost place has been attained by one in particular-namely, gold. If, then, in form C we replace the linen by gold, we get,

D. The Money-Form

20 yards of linen

1 coat

10 lb of tea

40 lb of coffee

1 qr. of corn

1/2 a ton of iron

x commodity A |

=

=

=

= 2 ounces of gold

=

=

= |

In passing from form A to form B, and from the latter to form C, the changes are fundamental. On the other hand, there is no difference between forms C and D, except that, in the latter, gold has assumed the equivalent form in the place of linen. Gold is in form D, what linen was in form C — the universal equivalent. The progress consists in this alone, that the character of direct and universal exchangeability — in other words, that the universal equivalent form — has now, by social custom, become finally identified with the substance, gold.

Gold is now money with reference to all other commodities only because it was previously, with reference to them, a simple commodity. Like all other commodities, it was also capable of serving as an equivalent, either as simple equivalent in isolated exchanges, or as particular equivalent by the side of others. Gradually it began to serve, within varying limits, as universal equivalent. So soon as it monopolises this position in the expression of value for the world of commodities, it becomes the money commodity, and then, and not till then, does form D become distinct from form C, and the general form of value become changed into the money-form.

The elementary expression of the relative value of a single commodity, such as linen, in terms of the commodity, such as gold, that plays the part of money, is the price-form of that commodity. The price-form of the linen is therefore